Boyfriend refuses to cover girlfriend’s debt — and the internet is calling it a relationship dealbreaker

Love is about support, but support doesn’t mean silently absorbing someone else’s debt without conversation or consent.

Every couple has its limit. For one, it came with a $9,000 price tag. A 30-year-old man took to Reddit to share his perspective on a financial conflict that sparked intense discussion online. He and his 28-year-old girlfriend, who have been together for almost three years, had started planning to move in together. Things were on course until money troubles caught them off guard. His girlfriend revealed she was living with $9,000 in credit card debt. She hadn’t brought it up earlier because she was embarrassed and hoped to manage it on her own before it became something they’d have to face together. But now, she was asking for help and told him that without a $300 to $500 monthly contribution toward the debt, moving in would have to wait.

The man said that he declined to help his girlfriend because he worked hard to remain debt-free and had always been a careful spender. "And while I don’t mind helping out here and there in a relationship, I don’t think it’s fair to expect me to take on someone else’s financial mess, especially before we even live together,” he wrote. His girlfriend didn’t take it well and accused him of being unsupportive because, from her point of view, his refusal wasn’t just about money. It was about their relationship’s long-term potential, and she implied that contributing to the debt would have been a sign of commitment. According to his post, things have gone downhill since that conversation, as she has become distant, communicates less, and seems emotionally withdrawn. “I feel like I’m being punished for setting a boundary," he concluded. "But I also don’t want to start living together on the wrong foot, feeling like I’m financially responsible for her past choices."

This story taps into an increasingly common debate about financial transparency, boundaries, and expectations in modern relationships. According to a Bankrate survey, 40% of adults in a relationship have kept financial details such as debts, expenses, or accounts hidden from their partner. A NerdWallet survey revealed that 10% of respondents said they would refuse to date someone with credit card debt. Meanwhile, a 2023 study by Bread Financial found that 64% of couples describe themselves as financially incompatible, and while 58% of Millennials and 57% of Gen Z report occasional money-related conflicts with their partners, only 30% of Boomers experience the same.

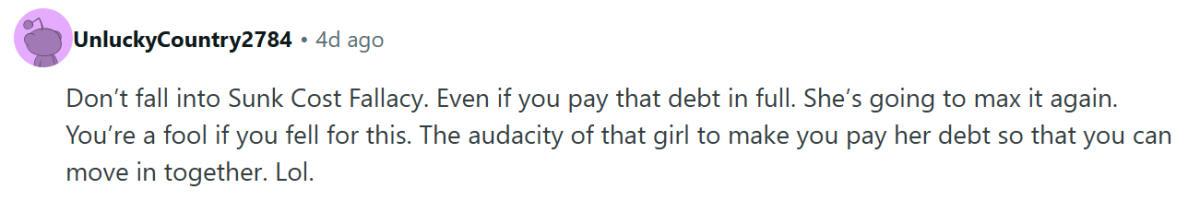

Though the original Reddit post has been deleted, the r/AITAH comment section where it was shared exploded with opinions. While some of them shared their stories, many of them backed the man’s decision, praising him for setting clear boundaries and refusing to take on someone else's financial baggage. u/SiriusGD wrote, "While you're paying it down, she'll be charging it back up. This is not the type of person that you want to get attached to.” “She was too embarrassed to tell you about the debt but not too embarrassed to ask you to pay for it?” asked u/Soft_Sea_225. u/Ok_Satisfaction_7466 added, “You are indeed being punished for setting a very reasonable boundary. I'd seriously rethink this relationship.”

Share on Facebook

Share on Facebook