Finance coach explains why she lives on a $50 a month budget and how easily she does it

'I feel like you’re beating the matrix by relearning a different way of living,' a comment read.

Budgeting is harder than it looks, especially after an exhausting workweek when the only thing you crave is a lavish weekend. However, finance coach Alexis Howard (@financiallybrave) has a different approach. She believes in a frugal lifestyle and is all about saving over spending. In a video posted to her TikTok account, Howard shares how she spends only $50 a month while living in San Francisco. Her video currently has 2 million views on TikTok.

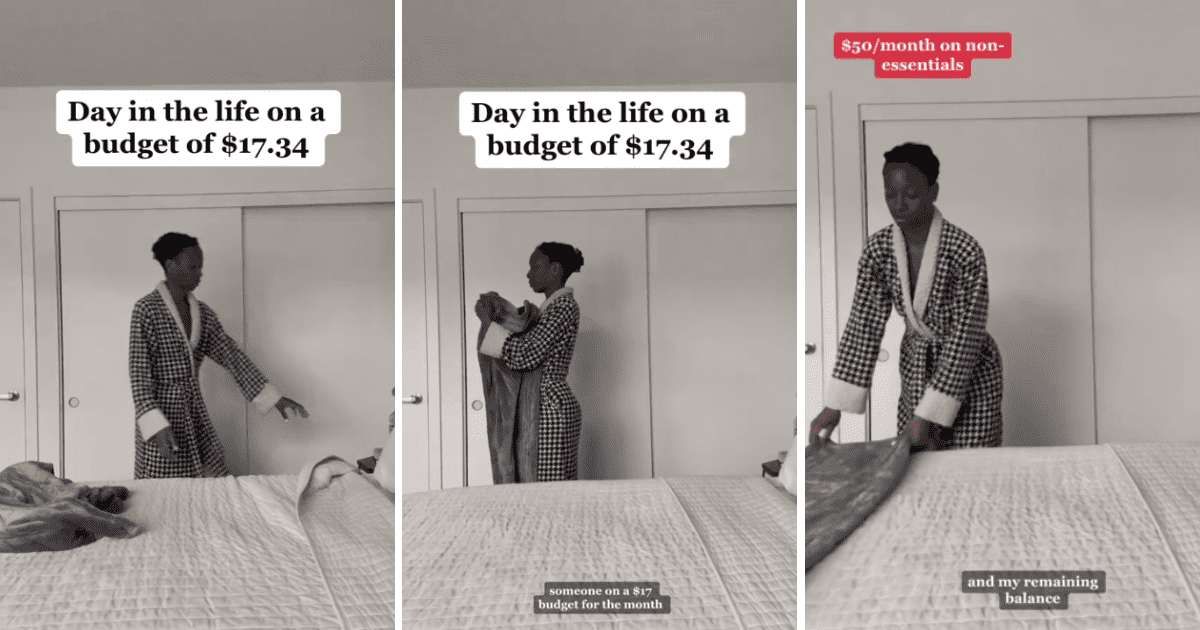

Howard opens the video by saying she can only spend $17.34 to achieve her 'living-on-$50-per-month challenge,' and so she decides to give viewers a sneak peek into a minimalist day in her life. "I have talked before about how the use of my two reality rules, in which you acknowledge both the negative and positive sides of a situation but then solely focus on the positive, is an important mindset to embrace when budgeting," she says in her video. Instead of taking an Uber, she rides the bus to work and says how that allows her to have some extra time to herself before starting her day. After completing all her work, Howard says she wants to go out and relax, but since she has to stick to a budget, she chooses to take her dog out for a walk and relax with this healthier alternative.

Moreover, she explains how she has saved money by not ordering food and eating ready-to-go meals. "I cannot stress enough how easy accessibility to food is, and it’s so helpful when trying to end a takeout habit," she adds. Nevertheless, Howard ends her day by treating herself to cinnamon rolls that are probably homemade. "And that was a day in the life of a girl on a budget," she says. Inflation has made it harder than ever for people to live on a budget as they are trying to cut down expenses offset by the rising costs of almost everything, including basic necessities. In fact, a survey by CNBC and Morning Consult found that 92% of Americans are pulling back on spending. They also found that nearly all (92%) middle-income Americans (earning between $50,000 and $100,000 a year) are worried about inflation. To manage expenditure, while many cut spending on non-essential goods like entertainment, home decor, and clothing, two-thirds of those surveyed said they spend less on even essential items, like groceries, utilities, and gas.

The TikTok video went viral in July 2023, with many people supporting the financial coach for a frugal lifestyle. For instance, @shevaanisen wrote, "I am proud of you for being able to do your part and bring awareness to it." @saaarettas commented, "The only way for me to achieve this is literally never leaving the house."

@laurarmoody wrote, "I feel like I could easily do this, but gas for getting to work is like $100 a week alone." @ceeekss commented, "This is so powerful in an age of consumerism! More people should do this and see how difficult it really is!" Howard always tries to look at the two sides of the coin — the positive and the negative. Impressed by her approach, @marsobsessed wrote, "I really like the two views on every situation. Acknowledging the positive and negative sides of the same coin. I am going to do this from now on." @cass365__ said, "I feel like you’re beating the matrix by relearning a different way of living — one that includes balancing emotions around money and that it’s okay to go without."

You can follow Alexis Howard(@financiallybrave) on TikTok for more financial advice.

More on Scoop Upworthy

Woman explains how she reduced her monthly grocery budget to under $100 while living in New York

People share 20 effective and clever ways to save money that are often overlooked

Man shares the best money-saving tips his 'cheap' parents taught him while growing up

This article originally appeared 1 month ago.

Share on Facebook

Share on Facebook